Investment Update: Bakar Labs Elevates UC Berkeley as Top Hub for Startups

By Kayla Leung and Kaspar Mossman.

Pitchbook recently rated UC Berkeley #1 in the world for venture-backed startups. True, that was for undergraduate-founded companies, rarely the case for biotech, but Berkeley is a top university for graduate student-founded companies as well. Bakar Labs is the place where many of these companies connect with investors.

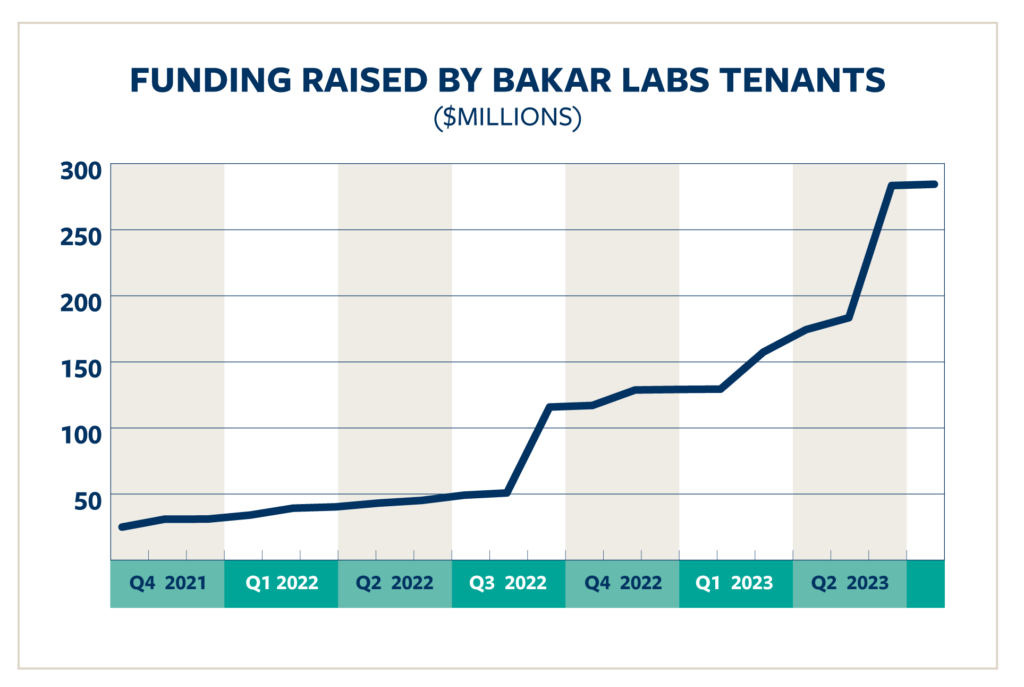

Since the launch of Bakar Labs in November 2021, our tenant companies have drawn increasing interest from investors. Here’s a snapshot of their progress.

Since joining Bakar Labs, 16 tenant companies have brought in $284 million from a network of 72 funds, including angel, corporate, and VC firms, including a16z, Bessemer Venture Partners, Deerfield Management, GV, J&J Innovation, Morningside, MRL Ventures, Novartis, Novo Holdings, S32, and venBio.

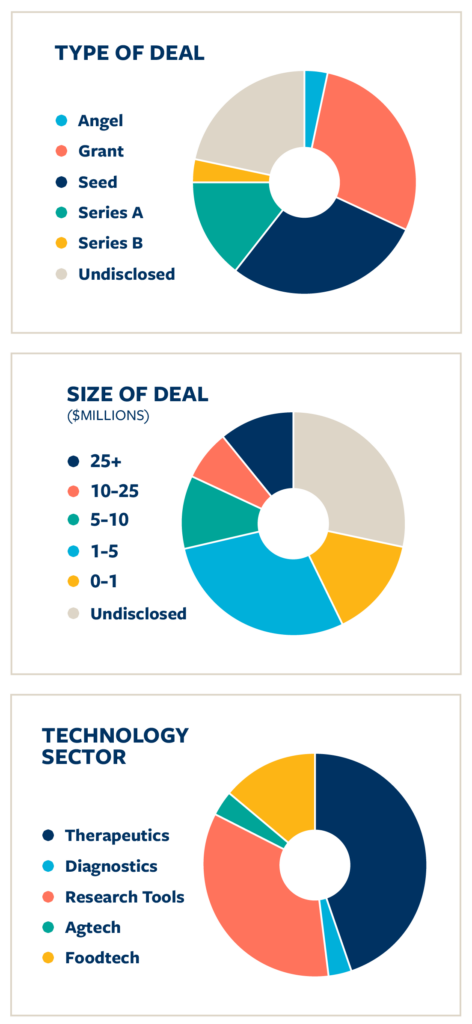

Deals ranged from grants through Series B, with the majority of rounds being in the range from pre-seed (typically marked “undisclosed”) through seed to Series A.

Grants represented a significant fraction of the number of funding events, highlighting the importance of agencies such as NIH and CIRM in providing non-dilutive funding.

UC Berkeley has several associated venture funds, with one notably headquartered at Bakar Labs. These funds have a combined capital commitment of over $200 million devoted to our startup ecosystem. In 2023, seven Bakar Labs companies received funding from these funds. We expect to see more in 2024.

While the majority of these investors or funds are based in the United States, 17 countries are represented, highlighting global interest in UC Berkeley and Bakar Labs innovation.

The incubator welcomes startups developing wet-lab technologies across life science, including therapeutics, diagnostics, research tools, foodtech, and agtech. Investment in our tenants to date has largely been made in two technology sectors: therapeutics and research tools/platforms, with foodtech coming third.

The trends at Bakar Labs (while the data is granular) broadly reflect the wider market, with a plateau in late 2022 and early 2023. The rate of deal-making currently appears to be picking up pace.

As this dynamic landscape continues to evolve, we will provide regular updates.